Formula total profit

Calculate present and future PV ratio. The cost of the goods sold and operating expenses during the year are 2000000 and 1000000 respectively.

Net Profit Bookkeeping Business Accounting Education Learn Accounting

Net profit is the amount of money earned by a business after all the operating expenses interest and tax expenses are deducted from the Gross profit.

. A Markup expressed as a percentage of cost price. Toll Free 1800 309 8859 91 80 25638240. The sales turnover and profit during two years were as follows.

Some examples of the fixed cost of production are selling expense rent expense. Also Operating Profit Margin Operating Profit Total Sales. Insert your figures into the formula.

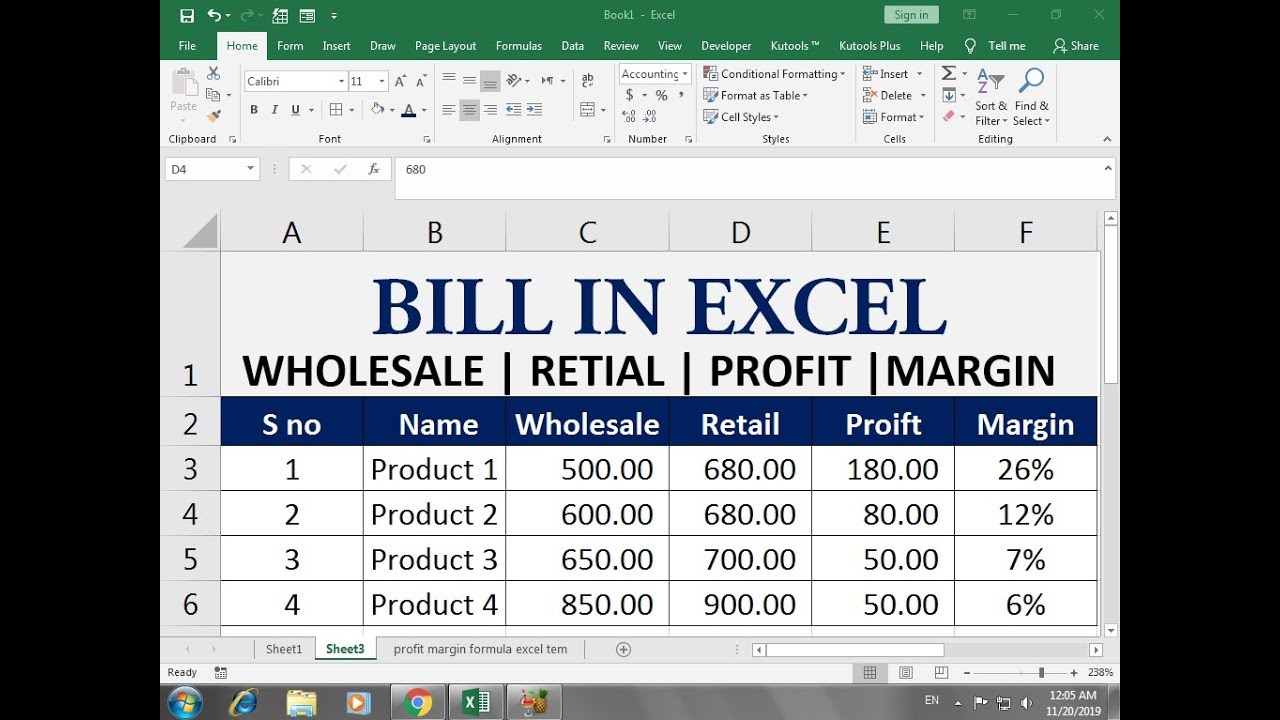

Gross profit is equal to net sales minus cost of goods sold. In this example the goal is to calculate and display profit margin as a percentage for each of the items shown in the table. Total Cost 20000 6 3000.

Profit is calculated using the formula given below. B Profit margin which is the percentage calculated using the selling. Therefore Airbus SE secured a profit of 1629 million from the business during the year ended on December 31 2018.

The total already exists in the named range total C15 which contains a formula based on the SUM function. Net sales are equal to total gross sales less returns inwards and discount allowed. Profit is determined by subtracting direct and indirect costs from all sales earned.

The basic components of the formula of gross profit ratio GP ratio are gross profit and net sales. The formula to calculate gross margin as a percentage is Gross Margin Total Revenue Cost of Goods SoldTotal Revenue x 100. Lets check what is profit before tax PBT with formula example.

Net Profit Margin Formula. The total will show the number of sales. The formula for total cost can be derived by using the following five steps.

What is the Net Profit Formula. Usually companies use this metric to help establish budgets forecast development potential and optimize investments. In other words given a price of 500 and a cost of 400 we want to return a profit margin.

Total Revenue - Total Expenses Profit. Toll Free 1800 309 8859 91 80 25638240. The gross profit margin is the gross profit over the revenue.

Operating profit Gross Profit Operating Expenses. Formula to Calculate Percentage. Paddle acquires ProfitWell to do it for you.

That cost which do not change with the change in the level of production. The formula to calculate. Total revenue 60000 3000 63000.

Use the gross profit formula to find out the total gross profit ie Gross Profit Revenue - Cost of goods sold. How many units must he sold to earn the present total profits. The formula to calculate the gross profit is Gross Profit Total Sales revenue - Cost of goods sold.

You are required to calculate. The formula to calculate profit is. It represents the actual sum of money made by any business.

Total Cost 38000 Explanation. Learn what net profit is how to calculate it using the net profit formula see some practical examples and how ProfitWell can help you get started. Following our net profit formula we have total expenses equal to 25000 2000 27000.

Let us take the example of the company having a total revenue earned during the year of 5000000. Profit percentage is of two types. Profit 1629 million.

To express a number between zero and one percentage formula is used. It is defined as a number represented as a fraction of 100. The target profit formula is a calculation used by businesses to estimate how much revenue the company should produce over a set period of time.

Using the above formula Company XYZs net profit margin would be 30000 100000 30. The formula to calculate the Operating Profit is. The profit percentage formula calculates the financial benefits left with the entity after it has paid all the expenses and is expressed as a percentage of cost price or selling price.

SUM C6C14. The gross profit margin helps in measuring a companys efficiency in production over a period of time. Firstly determine the cost of production which is fixed in nature ie.

Profit 63707 62078. There are two main reasons why net profit margin is useful. The Percentage Formula is given as.

Net profit margin is an easy number to examine when reviewing the profit of a company over a certain period. Profit Total Sales Total Expenses. It is denoted by the symbol and is majorly used to compare and find out ratios.

Direct costs can include purchases like materials and staff wages. The formula of gross profit margin or percentage is given below. Iii Profit when sales are Rs.

In its simplest form percent means per hundred. Shows Growth Trends. Why Net Profit Margin Is Important.

Net profit includes all the cost amount generated by the business as revenue. PBT or profit before tax is the total profit a business makes before income tax is applied on the revenue. It takes into account the various revenue sources and operating expenses.

The Gross Profit Margin shows the income a company has left over after paying off all direct expenses related to manufacturing a product or providing a service. I PV ratio ii Sales required to earn a profit of Rs. Gross Profit Margin Formula.

Operating Profit Formula Example 1.

Income Statement To Balance Sheet Relationship Profit And Loss Statement Accounting And Finance Accounting Services

Cost Of Goods Sold Formula Calculator Excel Template Cost Of Goods Sold Cost Of Goods Excel Templates

How To Calculate Net Profit Margin In Excel Net Profit Excel Billing Software

Business Excel Template Profit Loss Inventory Expense Revenue Etsy Excel Templates Profit And Loss Statement Excel

Genevieve Wood I Picked This Diagram Because Of The Side By Side View Of The Contribution Margin And Traditional Income Statement I Felt Like You Can Easily S

The Difference Between Gross Profit Margin And Net Profit Margin Net Profit Profit Company Financials

Techwalla Com How To Calculate Gross Profit Margin Using Excel Techwallacom B07bd92b Resumesample Resumefor Excel Gross Margin Calculator

Gross Vs Net Income Importance Differences And More Bookkeeping Business Learn Accounting Accounting Classes

Net Profit On Sales Accounting Play Accounting And Finance Accounting Basics Bookkeeping Business

Margin Definition Gross Profit Margin Profit Margin Formula Operating Profit Margin Infograph Financial Literacy Lessons Economics Lessons Finance Education

How To Calculate Gross Profit Margin 8 Steps With Pictures Profit Profitable Business Cost Of Goods Sold

Net Income Formula Calculation And Example Net Income Income Accounting Education

Gross Profit Vs Net Profit Definitions Formulas Examples Net Profit Accounting Training Profit

Sales Cost Of Goods Sold And Gross Profit Cost Of Goods Sold Cost Accounting Cost Of Goods

Excel Formula Get Profit Margin Percentage Excel Formula Excel Tutorials Start Up Business

Profit And Loss Basics And Methods Examples Math Tricks Math Tricks Math Basic

Operating Profit Margin Or Ebit Margin Profit Meant To Be Interpretation